Medicare coverage for chronic conditions can be complex and overwhelming. To navigate this intricate system effectively, it is crucial to understand the essential steps required.

This article provides a comprehensive guide to help individuals with chronic conditions access the coverage they need. By following these eight steps, readers will gain valuable insights into Medicare eligibility, enrollment, coverage options, and supplemental plans.

Stay informed, take control of your healthcare, and ensure you receive the power to advocate for your unique needs.

Key Takeaways

- Understand the eligibility criteria and enrollment process for Medicare to ensure seamless coverage for chronic conditions.

- Identify the specific coverage eligibility criteria and treatment options available for your chronic condition.

- Familiarize yourself with the different parts of Medicare (A, B, C, and D) and their benefits and coverage options.

- Choose the right Medicare plan that offers adequate coverage for your treatments, medications, and services, while considering costs and provider networks.

Understand Medicare Eligibility and Enrollment

To ensure proper coverage for chronic conditions, it is essential to understand Medicare eligibility and enrollment. Medicare is a federal health insurance program that primarily provides coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities. To be eligible for Medicare, one must meet specific criteria, including age and work history.

Understanding the enrollment process is equally important, as it determines when and how an individual can enroll in Medicare. There are different enrollment periods and deadlines that must be met to avoid penalties and ensure seamless coverage.

It is crucial to navigate the Medicare system with precision and knowledge to guarantee the power of accessing the necessary coverage for chronic conditions.

Identify Your Chronic Condition and Its Coverage Options

When it comes to identifying your chronic condition and understanding its coverage options under Medicare, there are three key points to consider.

First, you need to be aware of the coverage eligibility criteria specific to your condition, as these criteria can vary.

Second, it is important to explore the available treatment options that Medicare covers for your condition, ensuring that you have access to the necessary care.

Lastly, understanding your cost-sharing responsibilities, such as deductibles and co-payments, is essential in order to effectively manage the financial aspects of your chronic condition.

Coverage Eligibility Criteria

Identify your chronic condition and explore the coverage options available under Medicare by understanding the eligibility criteria.

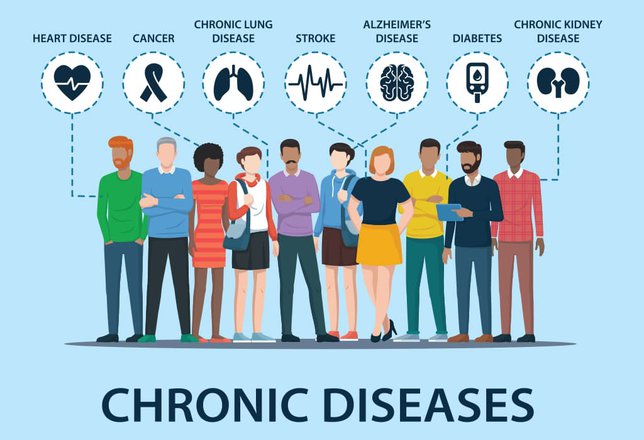

Medicare provides coverage for a wide range of chronic conditions, including but not limited to diabetes, heart disease, cancer, and arthritis. To determine if your condition is eligible for coverage, you must meet certain criteria established by Medicare.

These criteria typically include a diagnosis of a chronic condition by a healthcare professional, the need for medically necessary treatment, and the expectation that the condition will last for at least 12 months or result in death. Additionally, Medicare coverage may require that you meet certain age requirements or have a certain level of disability.

Understanding the eligibility criteria for your specific chronic condition is crucial in order to access the appropriate coverage options available through Medicare.

Available Treatment Options

Medicare provides a range of available treatment options for chronic conditions, ensuring individuals receive the necessary care and support for their specific healthcare needs. Here are four key treatment options that Medicare covers:

1) Medications: Medicare Part D covers prescription drugs, including those used to manage chronic conditions. It is important to review the formulary to ensure your specific medications are covered.

2) Doctor visits: Medicare Part B covers visits to doctors, specialists, and other healthcare providers. This includes regular check-ups, consultations, and follow-up appointments related to your chronic condition.

3) Hospital services: Medicare Part A covers inpatient hospital stays, including surgeries, treatments, and therapies related to your chronic condition.

4) Preventive services: Medicare covers a range of preventive services, such as screenings, vaccinations, and counseling, which can help identify and manage chronic conditions before they worsen.

Cost-Sharing Responsibilities

As individuals navigate the cost-sharing responsibilities of their Medicare coverage, it is essential to identify the specific chronic condition they have and explore the coverage options available to them. Understanding the cost-sharing responsibilities is crucial in managing healthcare expenses and ensuring adequate coverage for chronic conditions.

To help individuals make informed decisions, it is important to provide clear information about the coverage options. The table below outlines the cost-sharing responsibilities for different chronic conditions:

| Chronic Condition | Coverage Options | Cost-Sharing Responsibilities |

|---|---|---|

| Diabetes | Medicare Part B | Deductible and coinsurance |

| Heart Disease | Medicare Part A & B | Copayments and coinsurance |

| Cancer | Medicare Part A & B | Deductible and coinsurance |

| Arthritis | Medicare Part D | Copayments and coinsurance |

Familiarize Yourself With Medicare Parts A, B, C, and D

To understand your Medicare coverage for chronic conditions, it is important to familiarize yourself with the different parts of Medicare, including Parts A, B, C, and D. Each part offers specific benefits and coverage options that can help manage chronic conditions effectively. Here are the key things you need to know:

- Medicare Part A: This covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. It provides a foundation for your Medicare coverage.

- Medicare Part B: This covers outpatient care, doctor visits, preventive services, and medical supplies. It plays a crucial role in managing chronic conditions by providing access to necessary healthcare services.

- Medicare Part C (Medicare Advantage): This is an alternative to Original Medicare and offers additional benefits such as prescription drug coverage and wellness programs. It may provide more comprehensive coverage for chronic conditions.

- Medicare Part D: This covers prescription drug costs and is essential for individuals with chronic conditions who require ongoing medication.

Research Medicare Advantage Plans for Additional Coverage

One important step to consider is exploring Medicare Advantage plans for additional coverage options for managing chronic conditions. Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Medicare Parts A and B, and often include additional coverage such as prescription drugs, vision, dental, and hearing services. By researching Medicare Advantage plans, individuals with chronic conditions can find plans that specifically address their healthcare needs, offering specialized care and services that may not be covered by Original Medicare. Below is a table highlighting the potential additional coverage options offered by Medicare Advantage plans:

| Coverage Options | Description |

|---|---|

| Prescription drugs | Coverage for medications not covered by Original Medicare |

| Vision services | Coverage for eye exams, glasses, and contact lenses |

| Dental services | Coverage for dental exams, cleanings, and procedures |

| Hearing services | Coverage for hearing exams and hearing aids |

| Fitness programs | Coverage for gym memberships and wellness programs |

Review and Compare Medicare Supplement Plans

When it comes to ensuring comprehensive coverage for chronic conditions, it is crucial to carefully review and compare Medicare Supplement plans.

By doing so, individuals can identify the right plan that meets their specific needs and provides the necessary coverage for their chronic conditions.

Through a systematic comparison of different plans, individuals can make an informed decision and secure the most suitable coverage for their ongoing healthcare needs.

Choosing the Right Plan

A crucial step in obtaining Medicare coverage for chronic conditions is to carefully review and compare Medicare supplement plans. This process ensures that individuals choose the right plan that meets their specific healthcare needs.

To assist you in making an informed decision, here are four key factors to consider:

- Coverage and Benefits: Evaluate the extent of coverage provided by each plan, including hospital stays, doctor visits, prescription drugs, and preventive services. Look for plans that offer comprehensive coverage for your chronic condition.

- Costs: Compare premiums, deductibles, copayments, and coinsurance rates across different plans. Consider your budget and how much you can afford to pay out-of-pocket for medical expenses.

- Provider Network: Check if your preferred healthcare providers are included in the plan’s network. Ensure that you have access to specialists and hospitals that specialize in treating your chronic condition.

- Plan Ratings: Research the ratings and reviews of different Medicare supplement plans. Look for high ratings from reputable sources to ensure that you select a plan with a strong track record of customer satisfaction and quality care.

Coverage for Chronic Conditions

To ensure comprehensive coverage for chronic conditions, it is essential to review and compare Medicare supplement plans. Medicare supplement plans, also known as Medigap plans, are designed to fill the gaps in Medicare coverage and provide additional benefits.

When it comes to chronic conditions, it is crucial to choose a plan that offers adequate coverage for the specific treatments, medications, and services needed. By reviewing and comparing different plans, individuals can identify the ones that offer the best coverage for their specific chronic conditions.

Factors to consider include the cost of premiums, deductibles, co-pays, and the coverage limits for treatments and medications. Analyzing the details of each plan will empower individuals to make an informed decision and ensure they have the necessary coverage to manage their chronic conditions effectively.

Determine if You Qualify for Extra Help With Prescription Drug Costs

To qualify for extra help with prescription drug costs, you must meet certain eligibility criteria. Here are four key points to consider:

- Income: Your annual income should be below a certain limit. The exact amount varies each year, so it is crucial to check the current guidelines.

- Resources: Your total assets, including bank accounts, investments, and real estate, must be within a specific limit. Certain items, such as your primary residence and vehicle, are not counted towards this limit.

- Medicare Savings Programs: If you are eligible for a Medicare Savings Program, you automatically qualify for extra help with prescription drug costs. These programs help with Medicare premiums and, in some cases, other out-of-pocket costs.

- Application: You need to complete an application form to determine your eligibility for extra help. This can be done online, by mail, or by phone with the Social Security Administration.

Learn About Medicare’s Coverage of Preventive Services

Medicare’s coverage of preventive services plays a crucial role in maintaining the health and well-being of individuals with chronic conditions. These services are aimed at preventing illnesses, detecting potential health issues early, and promoting overall wellness. By taking advantage of these services, individuals can proactively manage their chronic conditions and potentially avoid further complications.

To help you better understand the preventive services covered by Medicare, here is a table outlining some of the key services:

| Preventive Service | Description |

|---|---|

| Annual Wellness Visit | A comprehensive yearly check-up to assess your overall health and identify any potential risks or concerns. |

| Vaccinations | Medicare covers a range of vaccines, including those for influenza, pneumococcal disease, and hepatitis B. |

| Screenings | Medicare covers various screenings such as mammograms, colonoscopies, and lung cancer screenings, which are essential for early detection of diseases. |

Stay Informed and Advocate for Your Healthcare Needs

It is important for individuals with chronic conditions to stay informed and advocate for their healthcare needs. By staying informed and actively advocating for their healthcare, individuals can ensure they receive the appropriate medical care and support they require.

Here are four essential steps to help individuals with chronic conditions stay informed and advocate for their healthcare needs:

- Research: Stay up-to-date with the latest medical research, treatment options, and advancements related to your condition. This will empower you to make informed decisions about your healthcare.

- Communication: Develop open and honest communication with your healthcare providers. Clearly express your concerns, symptoms, and treatment preferences, and ask questions to ensure you understand your condition and treatment plan.

- Support Networks: Seek out support networks, such as patient advocacy groups or online communities, where you can connect with others who share similar experiences and learn from their insights and advice.

- Be Proactive: Take an active role in managing your healthcare. Keep track of your medical records, appointments, and medications. Be assertive in seeking second opinions or requesting referrals to specialists if necessary.

Frequently Asked Questions

What Are the Eligibility Requirements for Medicare Coverage of Chronic Conditions?

To be eligible for Medicare coverage of chronic conditions, individuals must meet certain requirements, including being enrolled in Medicare Part B, having a chronic condition that meets the criteria, and receiving treatment from a healthcare professional.

Can I Enroll in Medicare if I Have a Pre-Existing Chronic Condition?

Yes, individuals with pre-existing chronic conditions can enroll in Medicare. Medicare does not discriminate based on pre-existing conditions and offers coverage for a variety of chronic conditions through its various plans and programs.

How Do I Determine Which Medicare Part Covers My Specific Chronic Condition?

To determine which Medicare part covers a specific chronic condition, it is essential to consult the Medicare coverage guidelines and review the benefits and services offered by each part. Consider factors such as medication coverage, doctor visits, and specialized care options.

Are There Any Limitations or Restrictions on Medicare Coverage for Chronic Conditions?

Medicare coverage for chronic conditions may be subject to limitations or restrictions. It is important to understand the specific criteria and requirements set by Medicare to ensure eligibility and access to necessary treatments and services.

How Can I Ensure That My Healthcare Needs Are Being Properly Advocated for Under Medicare?

In order to ensure proper advocacy for your healthcare needs under Medicare, it is important to understand the available coverage options, stay informed about policy changes, and actively communicate with healthcare providers and Medicare representatives.