Wind energy is emerging as a promising and sustainable alternative to conventional energy sources. However, before embarking on a wind energy project, it is crucial to assess its economic feasibility to ensure a successful venture. This article presents a comprehensive guide on how to assess the economic feasibility of a wind energy project.

By understanding the basics of wind energy, calculating costs, assessing potential revenue streams, analyzing the return on investment, considering site selection factors, evaluating risks and mitigation strategies, conducting a financial sensitivity analysis, comparing with other renewable energy options, and seeking expert advice, stakeholders can make informed decisions regarding the viability of a wind energy project.

This objective and impersonal approach allows for a thorough examination of key factors that contribute to the economic feasibility of such projects, facilitating sound investment choices in the renewable energy sector.

Key Takeaways

- Understanding the basics of wind energy is crucial for evaluating the economic feasibility of a wind energy project.

- The costs of wind energy projects include upfront expenses such as land acquisition, permits, and turbine procurement, as well as ongoing expenses like operation, maintenance, and insurance.

- Revenue streams for wind energy projects can come from power purchase agreements, feed-in tariffs, and renewable energy certificates.

- Assessing wind resource variability, considering factors such as historical data and computer models, is essential for estimating energy production and optimizing wind turbine design.

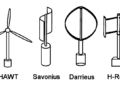

Understand the Basics of Wind Energy

The fundamentals of wind energy must be comprehended in order to evaluate the economic viability of a wind energy project.

Wind energy is harnessed by converting the kinetic energy of the wind into mechanical power, which is then converted into electrical power through the use of turbines.

The amount of electricity generated by a wind turbine is directly proportional to the wind speed, with higher wind speeds resulting in greater power output.

Additionally, the capacity factor, which measures the actual energy output of a turbine compared to its maximum potential output, is a crucial factor when assessing the economic feasibility of a wind energy project.

Other factors that need to be considered include the cost of installing and maintaining the turbines, as well as the potential revenue from selling the generated electricity.

By understanding these basics, one can effectively evaluate the economic feasibility of a wind energy project.

Calculate the Costs

Calculate the costs involved in a potential wind energy venture to determine its financial viability.

The costs of a wind energy project can be divided into two main categories: upfront costs and ongoing costs. Upfront costs include expenses such as land acquisition, permits and licenses, turbine procurement and installation, and grid connection. These costs can vary depending on factors like the size and capacity of the project, location, and the type of wind turbines used.

Ongoing costs include operation and maintenance expenses, insurance, and monitoring and repair costs.

It is also important to consider the potential revenue generated from selling electricity produced by the wind turbines.

By carefully analyzing and estimating all these costs, investors and developers can assess the economic feasibility of a wind energy project and make informed decisions about its implementation.

Assess the Potential Revenue Streams

To determine the financial viability of a potential wind energy venture, it is crucial to analyze and estimate the potential revenue streams generated from the sale of electricity produced by the wind turbines. The revenue streams of a wind energy project can come from various sources, including power purchase agreements (PPAs), feed-in tariffs (FITs), and renewable energy certificates (RECs). PPAs involve selling electricity directly to a utility or another buyer at a fixed price over a specific period. FITs provide a guaranteed payment for every kilowatt-hour of electricity generated. RECs, on the other hand, represent the environmental attributes of the renewable energy and can be sold separately. By considering these revenue streams, developers can assess the project’s economic feasibility and determine if it can generate sufficient income to cover the costs and provide a reasonable return on investment.

| Revenue Streams | Description |

|---|---|

| Power Purchase Agreements (PPAs) | Direct sale of electricity to a utility or buyer at a fixed price over a specific period. |

| Feed-in Tariffs (FITs) | Guaranteed payment for every kilowatt-hour of electricity generated. |

| Renewable Energy Certificates (RECs) | Sale of environmental attributes of the renewable energy separately. |

Analyze the Return on Investment (ROI)

This discussion will focus on analyzing the return on investment (ROI) in a wind energy project.

Key points to consider include the payback period and breakeven point, which provide insights into the time it takes to recover the initial investment and reach profitability.

Additionally, the discounted cash flow analysis can help evaluate the project’s profitability by considering the time value of money and adjusting future cash flows accordingly.

Payback period and breakeven point

The determination of the payback period and breakeven point is crucial in evaluating the economic viability of a wind energy project.

The payback period refers to the length of time required for the project’s cash inflows to equal the initial investment. It provides a measure of how quickly the project will generate enough cash to recover the initial costs. A shorter payback period is generally preferred as it signifies a faster return on investment.

Additionally, the breakeven point represents the level of operation at which the project’s revenues cover both its fixed and variable costs. It indicates the minimum level of production or sales required to avoid incurring losses.

Calculating and analyzing these metrics allows project developers and investors to assess the financial feasibility of wind energy projects and make informed decisions regarding their implementation.

Discounted cash flow analysis

Discounted cash flow analysis is a method used to evaluate the financial viability of a venture by calculating the present value of its projected future cash flows. This analysis takes into account the fact that money received in the future is worth less than money received today due to the time value of money. By discounting future cash flows, the analysis determines the net present value (NPV) of the project, which indicates whether the venture is financially feasible or not.

To conduct a discounted cash flow analysis for a wind energy project, the following steps can be followed:

- Estimate the project’s cash flows over its expected lifespan, including investment costs, operating expenses, and revenues generated.

- Determine the appropriate discount rate to reflect the project’s risk and opportunity cost of capital.

- Calculate the NPV by discounting the projected cash flows to their present value using the chosen discount rate. If the NPV is positive, the project is considered financially feasible.

Discounted cash flow analysis provides a comprehensive evaluation of the economic feasibility of a wind energy project, considering the time value of money and allowing decision-makers to make informed investment decisions.

Evaluating the project’s profitability

Evaluating the profitability of a wind energy project involves analyzing its potential financial returns based on discounted cash flow analysis. This evaluation method takes into account the time value of money by discounting future cash flows to their present value.

The profitability of a project is typically assessed by calculating key financial indicators such as net present value (NPV), internal rate of return (IRR), and payback period. NPV measures the difference between the present value of cash inflows and outflows, providing an indication of the project’s economic viability. A positive NPV suggests that the project is expected to generate more cash inflows than outflows, indicating a potentially profitable venture.

IRR represents the rate at which the project’s net cash flows are equal to zero, with higher values indicating greater profitability. The payback period calculates the time required for the project to recover its initial investment, with shorter periods denoting higher profitability.

By evaluating these financial indicators, stakeholders can determine the economic feasibility and profitability of a wind energy project.

Consider the Site Selection Factors

Considering the site selection factors for a wind energy project involves analyzing various geographical, meteorological, and environmental parameters.

Geographical factors include the proximity to transmission lines and road infrastructure, as well as the availability of suitable land.

Meteorological factors, such as wind speed and direction, are crucial in determining the energy output and the project’s viability.

Environmental factors encompass potential impacts on wildlife, ecosystems, and local communities. These factors are assessed through environmental impact studies and consultations with stakeholders.

Additionally, land use and zoning regulations play a significant role in determining the feasibility of a wind energy project.

Site selection is a critical step in evaluating the economic viability of a wind energy project, as it directly influences the energy generation potential, project costs, and potential environmental impacts.

Evaluate the Risks and Mitigation Strategies

This discussion will focus on evaluating the risks and mitigation strategies associated with wind energy projects.

One key point to consider is the variability of wind resources, which can affect the overall energy production and financial viability of the project.

Another important risk is the potential for equipment failure and downtime, which can lead to decreased energy production and increased maintenance costs.

Additionally, regulatory and policy risks should be assessed, as changes in government policies or regulations can impact the project’s profitability and feasibility.

Variability of wind resources

The variability of wind resources is a crucial factor to assess when determining the economic feasibility of a wind energy project. Wind resources exhibit natural fluctuations in speed and direction, which directly impact the energy output of wind turbines. This variability introduces uncertainty in the power generation potential and can significantly influence project revenues.

To evaluate the impact of wind resource variability, extensive data analysis is required. Long-term historical wind data, collected from meteorological stations or wind measurement campaigns, is analyzed using statistical methods to determine the frequency and intensity of wind variations. Additionally, computer models are used to simulate and predict wind patterns over time.

Understanding the variability of wind resources allows project developers to accurately estimate energy production, assess project risks, and optimize the design and operation of wind turbines to maximize economic returns.

Potential for equipment failure and downtime

Equipment failure and downtime pose a critical challenge in the wind energy sector, demanding close attention to ensure uninterrupted operation and maximize energy production. Wind turbines consist of various mechanical and electrical components that are susceptible to failure due to factors such as extreme weather conditions, wear and tear, and manufacturing defects. The potential for equipment failure and subsequent downtime can result in substantial financial losses for wind energy projects. To assess the economic feasibility of a wind energy project, it is essential to consider the reliability and performance of the equipment used. A systematic approach is required, including regular maintenance, monitoring, and timely repairs to minimize the risk of equipment failure and downtime. Furthermore, incorporating advanced condition monitoring techniques and predictive maintenance strategies can help identify potential issues beforehand and mitigate the impact of equipment failure on energy production.

| Factors Contributing to Equipment Failure | Impact of Equipment Failure | Mitigation Strategies |

|---|---|---|

| Extreme weather conditions | Reduced energy production and increased costs | Regular maintenance and inspections |

| Wear and tear | Decreased turbine efficiency | Timely repairs and component replacement |

| Manufacturing defects | Safety hazards and operational disruptions | Quality control measures during manufacturing process |

Regulatory and policy risks

Regulatory and policy risks in the wind energy sector require careful consideration to ensure the smooth operation and long-term success of projects. These risks encompass a range of factors including changes in government policies, regulations, and incentives that could impact the financial viability of a wind energy project.

For instance, the expiration or reduction of tax credits, feed-in tariffs, or renewable portfolio standards could significantly affect the project’s profitability. Additionally, changes in zoning regulations or permitting requirements may result in delays or increased costs.

It is crucial for developers and investors to closely monitor and assess these risks to make informed decisions. Engaging with policymakers, participating in public consultations, and staying up-to-date with regulatory changes can help mitigate potential adverse effects and ensure compliance with the evolving legal framework governing wind energy projects.

Conduct a Financial Sensitivity Analysis

Conducting a financial sensitivity analysis is essential in assessing the economic feasibility of a wind energy project, as it allows for the evaluation of the project’s profitability under various financial scenarios. This analysis involves testing the project’s sensitivity to changes in key financial variables such as capital costs, operating expenses, and electricity prices. By varying these factors within a predetermined range, the analysis assesses the impact on the project’s net present value (NPV) and internal rate of return (IRR). The results of the analysis provide insights into the project’s vulnerability to financial risks and uncertainties, helping stakeholders make informed decisions. To illustrate the potential outcomes, a 2 column and 5 row table is presented below:

| NPV (USD) | IRR (%) | |

|---|---|---|

| Low | -500,000 | 5 |

| Base | 1,000,000 | 10 |

| High | 2,500,000 | 15 |

| Extreme Low | -1,000,000 | 2 |

| Extreme High | 5,000,000 | 20 |

This table demonstrates the range of NPV and IRR values that the project may yield under different financial scenarios, highlighting the importance of conducting a financial sensitivity analysis in assessing its economic feasibility.

Compare with Other Renewable Energy Options

When considering the viability of renewable energy options, it is crucial to compare the financial performance of wind energy projects with other available alternatives. This allows for a comprehensive assessment of the economic feasibility of wind energy projects.

One common alternative to wind energy is solar energy. Both wind and solar energy projects require significant upfront investment costs, but the ongoing maintenance costs for wind energy projects tend to be lower compared to solar energy projects. Additionally, the availability of wind resources is more reliable and consistent compared to solar resources in certain regions.

However, it is essential to consider the specific geographical location and environmental conditions when comparing wind and solar energy options. By conducting a thorough comparison, stakeholders can make informed decisions regarding the economic viability of wind energy projects in relation to other renewable energy options.

Seek Expert Advice and Consultation

Seeking expert advice and consultation from industry professionals can be a valuable strategy in order to gain insights and make informed decisions about the viability of wind energy projects compared to other renewable energy options. By consulting with experts in the field, developers can benefit from their extensive knowledge and experience, which can help identify potential challenges and opportunities specific to wind energy projects. These professionals can provide valuable insights on various aspects such as project feasibility, cost-effectiveness, technical requirements, and regulatory considerations.

Additionally, experts can offer guidance on optimizing the design, site selection, and integration of wind energy systems. By leveraging the expertise of industry professionals, developers can enhance their understanding of wind energy projects and make more informed decisions, ultimately improving the economic feasibility of their ventures.

Benefits of seeking expert advice and consultation include:

- Access to specialized knowledge and experience

- Identification of potential challenges and opportunities

- Guidance on project optimization and integration

Expert advice can help with:

- Assessing project feasibility and viability

- Evaluating cost-effectiveness

- Addressing technical requirements and regulatory considerations

Frequently Asked Questions

How can I determine the environmental impact of a wind energy project?

To determine the environmental impact of a wind energy project, various factors such as land use, wildlife displacement, noise pollution, and visual aesthetics need to be assessed. Environmental impact assessments and studies can provide valuable insights into the project’s effects on the environment.

When evaluating the social acceptance of a wind energy project, factors to consider include community engagement, public opinion, cultural and historical significance, job creation, and potential impacts on local infrastructure, health, and tourism.

Are there any legal or regulatory challenges that could affect the economic feasibility of a wind energy project?

Legal and regulatory challenges can potentially affect the economic feasibility of a wind energy project. These challenges may include obtaining permits and approvals, complying with environmental regulations, and navigating complex energy policies and incentives.

How can I assess the long-term maintenance and operation costs of a wind energy project?

To assess the long-term maintenance and operation costs of a wind energy project, various factors should be considered, such as equipment maintenance, repairs, monitoring, insurance, personnel, and grid connection fees. Accurate cost estimation is crucial for project planning and financial viability.

What are the potential benefits and drawbacks of integrating a wind energy project with an existing power grid?

Integrating a wind energy project with an existing power grid has potential benefits such as increased renewable energy generation and reduced carbon emissions. However, drawbacks include grid stability challenges and the need for additional infrastructure and investments to accommodate intermittent wind power.